Content

Then, mark the next line, with the words ‘Retained Earnings Statement’. Finally, provide the year for which such a statement is being prepared in the third line (For the Year Ended 2019 in this case). The retained earnings amount can also be used for share repurchase to improve the value of your company stock. However, if you have one or two investors in your business, you’ll want to list the amount of money distributed to them during this period. Preparing a statement of retained earnings can be beneficial for a variety of reasons, including the following.

Therefore, the retained earnings value on the balance sheet is a running total of additional gains minus dividends. The difference between the beginning balance and the ending balance indicates the change in retained earnings during the accounting period. You will need to list your amount of retained earnings at the end of the previous accounting period. You can obtain this information from your business’s balance sheet or previous statement of retained earnings.

Beginning of Period Retained Earnings

By comparing retained earnings balances over time, investors can better predict future dividend payments and improvements to share price. A statement of retained earnings can be a standalone document or appended to the balance sheet at the end of each accounting period. Like other financial statements, a retained earnings statement is structured as an equation. Negative retained earnings mean a negative balance of retained earnings as appearing on the balance sheet under stockholder’s equity. A business entity can have a negative retained earnings balance if it has been incurring net losses or distributing more dividends than what is there in the retained earnings account over the years. But not all of the shareholder’s equity is made up of profits that haven’t been distributed.

Businesses usually publish a retained earnings statement on a quarterly and yearly basis. That’s because these statements hold essential information for business investors and lenders. As mentioned earlier, retained earnings appear under the shareholder’s equity section on the liability side of the balance sheet. Companies today show it separately, pretty much the way its shown below. For instance, a company may declare a stock dividend of 10%, as per which the company would have to issue 0.10 shares for each share held by the existing stockholders.

What Is the Difference Between Retained Earnings and Revenue?

Revenue is the money generated by a company during a period but before operating expenses and overhead costs are deducted. In some industries, revenue is called gross sales because the gross figure is calculated before any deductions. Retained earnings are also called earnings surplus and represent reserve money, which is https://www.bookstime.com/ available to company management for reinvesting back into the business. When expressed as a percentage of total earnings, it is also called the retention ratio and is equal to (1 – the dividend payout ratio). While a trial balance is not a financial statement, this internal report is a useful tool for business owners.

Which of the following is not on a statement of retained earnings?

The balance of service revenue is reported on the income statement and not on the retained earnings statement.

The right financial statement to use will always depend on the decision you’re facing and the type of information you need in order to make that decision. If the company is experiencing a net loss on their Income Statement, then the net loss is subtracted https://www.bookstime.com/articles/retained-earnings-statement-example from the existing retained earnings. The Statement of Retained Earnings shows the accumulated portion of a business’s Profits that are not distributed as Dividends to shareholders but instead are reserved for reinvestment back into the business.

What is retained earnings? How to calculate them

This balance sheet ensures that the assets on the books of a company are equal to the sum of the company’s liabilities and stockholder equity. At some point in your business accounting processes, you may need to prepare a statement of retained earnings, which helps people understand what a business has done with its profits. Most good accounting software can help you create a statement of retained earnings for your business. The retained earnings are calculated by adding net income to (or subtracting net losses from) the previous term’s retained earnings and then subtracting any net dividend(s) paid to the shareholders. Retained earnings are the portion of a company’s cumulative profit that is held or retained and saved for future use. Retained earnings could be used for funding an expansion or paying dividends to shareholders at a later date.

The difference between the capital market and the stock market is that the stock market only deals with stocks, while the capital market includes stocks, bonds, and other capital assets. A statement of retained earnings can be extremely simple or very detailed. You may have noticed that independent contractor payments are now reported on the tax form 1099-NEC rather than the 1099-MISC. Here’s everything you need to know about this new informational IRS form.

How to Calculate the Effect of a Cash Dividend on Retained Earnings?

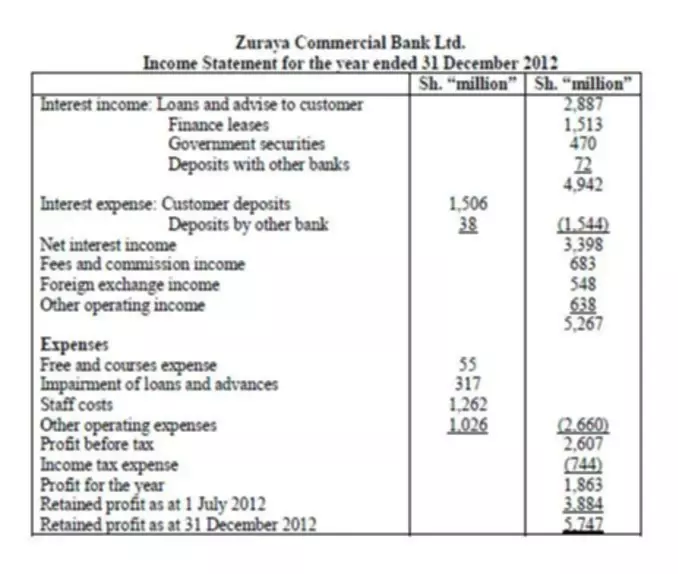

Once accounting for non-operating income and expenses and subtracting taxes, the company showed a net income of $3.9B. In 2019, Proctor and Gamble distributed $7.3B to owners of common stock as a dividend. The statement of retained earnings shows that the balance of the retained earnings went from $98.6B at the beginning of the year to $94.9B at the end of the year. The reduction of $3.7B mostly came from paying more out in dividends than the company generated in net income. The statement of retained earnings can be prepared from the company’s balance sheet. The assets, liabilities, and stockholder equity are all considered to ensure the assets match the sum of liabilities and stockholder equity.

We have all of the ingredients (elements of the financial statements) ready, so let’s now return to the financial statements themselves. Let’s use as an example a fictitious company named Cheesy Chuck’s Classic Corn. This company is a small retail store that makes and sells a variety of gourmet popcorn treats.

How do you calculate retained earnings?

Retained Earnings are profits held by a company in reserve in order to invest in future projects rather than distributed as dividends to shareholders. Retained earnings are affected by an increase or decrease in the net income and amount of dividends paid to the stockholders. Thus, any item that leads to an increase or decrease in the net income would impact the retained earnings balance. Retained earnings appear under the shareholder’s equity section on the liability side of the balance sheet. Retained earnings are the residual net profits after distributing dividends to the stockholders. Thus, at 100,000 shares, the market value per share was $20 ($2Million/100,000).

What is the purpose of the retained earnings statement?

Retained earnings are an important variable for assessing a company's financial health because it shows the net income that a company has saved over time, and therefore has the ability to reinvest in the business or distribute to shareholders.

Say, if the company had a total of 100,000 outstanding shares prior to the stock dividend, it now has 110,000 (100,000 + 0.10×100,000) outstanding shares. So, if you as an investor had a 0.2% (200/100,000) stake in the company prior to the stock dividend, you still own a 0.2% stake (220/110,000). Thus, if the company had a market value of $2 million before the stock dividend declaration, it’s market value still is $2 million after the stock dividend is declared. This is because due to the increase in the number of shares, dilution of the shareholding takes place, which reduces the book value per share. And this reduction in book value per share reduces the market price of the share accordingly.

Purpose of Retained Earnings Statement

During the same period, the total earnings per share (EPS) was $13.61, while the total dividend paid out by the company was $3.38 per share. In a perfect world, you’d always have more money flowing into your business than flowing out. Retained earnings are the profits that remain in your business after all costs have been paid and all distributions have been paid out to shareholders. Dividends are a debit in the retained earnings account whether paid or not. There are businesses with more complex balance sheets that include more line items and numbers. However, because different companies have different sizes, you do not necessarily want to compare the balance sheets of two different companies.

- These are the long term investors who seek periodic payments in the form of dividends as a return on the money invested by them in your company.

- A maturing company may not have many options or high-return projects for which to use the surplus cash, and it may prefer handing out dividends.

- You can either distribute surplus income as dividends or reinvest the same as retained earnings.

- As an important concept in accounting, the word “retained” captures the fact that because those earnings were not paid out to shareholders as dividends, they were instead retained by the company.

As the formula suggests, retained earnings are dependent on the corresponding figure of the previous term. The resultant number may be either positive or negative, depending upon the net income or loss generated by the company over time. Alternatively, the company paying large dividends that exceed the other figures can also lead to the retained earnings going negative. If you’re calculating retained earnings for the first time, your beginning balance is zero.

This information is neither individualized nor a research report, and must not serve as the basis for any investment decision. Before making decisions with legal, tax, or accounting effects, you should consult appropriate professionals. Information is from sources deemed reliable on the date of publication, but Robinhood does not guarantee its accuracy. The statement of retained earnings is generally more condensed than other financial statements.

Zoom Video Communications Reports Financial Results for the First … – Zoom Investor Relations

Zoom Video Communications Reports Financial Results for the First ….

Posted: Mon, 22 May 2023 07:00:00 GMT [source]