Contents:

Oanda charges lower financing costs when compared to margin interest rates at some Canadian brokerages. For example, as of July 13, 2022, the annual long rate for the S&P 500 was 4.03%. While that’s higher than brokers like Interactive Brokers, it does give you access to leverage not offered by other brokers. CIBC charges an annual account fee of $100 if your account balance is $10,000 or less.

To get things rolling, let’s go over some lingo related to broker fees. Scam-Rescue is a website whose purpose is to provide direct access to reliable businesses in the the field of funds recovery and investment brokers. The information on this website is not directed at residents of any country, where such distribution is against local laws or regulation. We are not responsible for any losses you may incur, by investing with a company mentioned on this website.

An invitation will be sent to insured customers to file their claims against the ICF member concerned. There are scammers out there, but there are also many reputable online brokers that will work hard to help you grow your trading career. More and more, online brokers are catering to new investors, so a lack of experience shouldn’t be a barrier to starting online trading.

This means that buying and selling U.S. stocks will come with a 3% round trip fee. We also like how transparently Trading 212 displays the fees. For example, the daily swap rates are available and can be easily accessed through the website or the trading platform. In the sections below, you will find the most relevant fees forex broker of Trading 212 for each asset class. For example, in the case of forex and stock index trading the most important fees are spreads, commissions and financing rates.

© 2023 Bijouterie Déziel Joailliers Octantis Courtier Web / Web Broker

This is charged daily overnight, and depends on the security. For example, U.S. stocks have an overnight interest rate of 0.0189% for buy positions and 0.0144% for sell positions. This equals to a 6.9% annual margin rate charged for buy positions, which may be higher than margin rates offered by traditional brokerages.

Eightcap Review 2023: Is It a Legit Forex Broker? – CryptoNewsZ

Eightcap Review 2023: Is It a Legit Forex Broker?.

Posted: Fri, 07 Oct 2022 14:26:05 GMT [source]

https://forex-reviews.org/.com, part of GAIN Capital, is a forex broker regulated by the IIROC in Canada. FOREX.com offers 3,000 stocks, 1,000 stock CFDs, 80 forex currency pairs, and a wide variety of indices and commodities. If you’re between the ages of 18 and 30, you can qualify for Qtrade’s young investor pricing if you set up an automatic pre-authorized deposit of at least $50 per month to Qtrade. This gives you access to $7.75 commissions, a discount from the regular $8.75 commissions, plus no account minimums and admin fees. To avoid this, you can pay a $10 monthly subscription to get access to Wealthsimple’s Plus plan, which allows you to open an U.S. The Plus plan also gives you unlimited real-time quotes.

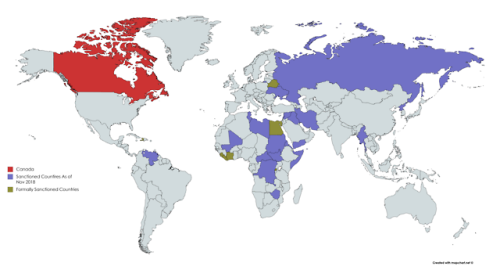

IFSC Forex Regulated Brokers

Swap charges are a bit higher than some other broker accounts that I have. FBS is authorized and regulated by the Belize International Financial Services Commission . Non-Qualified Accounts that do not fall within the categories outlined in and , which are brokerage accounts or mutual fund accounts. Ninety percent of traders lose money, largely due to lack of planning, training, discipline, not having a trading edge and having poor money management rules. All forex traders, and we do mean ALL traders, LOSE money on some trades. When the legitimacy of the client’s claim concerning the crime of an ICF member is proven beyond a reasonable doubt, the ICF is ready to pay up to 20,000 euros to cover losses.

![]()

Negative balances for cash and registered accounts come with heavy interest penalties. If you have a cash balance of more than $2 million, you’ll also earn interest at a credit rate of 0.10%. FDC — the general distribution agent for all of Fidelity’s U.S. mutual funds.

“Non-Qualified Accounts” means, collectively, those accounts of the Filers that are described in paragraph 8. “FMR” means FMR LLC, the parent company of a number of subsidiaries, including the Filers, which collectively hold themselves out to the public as “Fidelity Investments”. At Canada Paving & Construction LTD. we have worked with many notable clients including Costco Canada, Bayshore Shopping Centre, Carleton University, and many more.

I had a cent account with them

Only Canadian and U.S. stock exchanges are supported, with a commission of $9.95 per stock and ETF trade. When converting foreign currency, BMO InvestorLine charges a spread that can be as high as 1.75%. On the negative side, the news lacks charts and other visual elements. First, if you fund your account in the same currency as your bank account, you are not charged a currency conversion fee. Second, if you dowmarkets reviews trade assets in the same currency as your account base currency, you don’t have to pay a conversion fee.

Convenience and cost reduction are two of the biggest advantages to online brokers. Online brokers are faster, allowing you to conduct trades with the click of a button, as opposed to a phone call to a personal broker. Bloomberg found that investors pay an average of just $5-$10 in trade fees with online brokers. These fees are cheaper than what you’ll find with a personal broker, who usually has an average fee of $150.

We are beyond grateful to our clients for their cooperation and endless patience. Enforcement proceedings, membership lists, continuing education, investor education resources and any other information not set out above continue to reside on and State securities legislation in the United States of America. In connection with trades made for the Non-Qualified Accounts, the Filers comply, in all material respects, with the Transition Plan. In connection with trades made for the Non-Qualified Accounts, the Filer complies, in all material respects, with the Transition Plan.

Margin requirements for stock trades start from 15% in Canada and 30% in the U.S. You can fund your account with a credit card, debit card, or by wire transfer. There are no deposit fees, however, some credit cards may charge a cash advance fee.

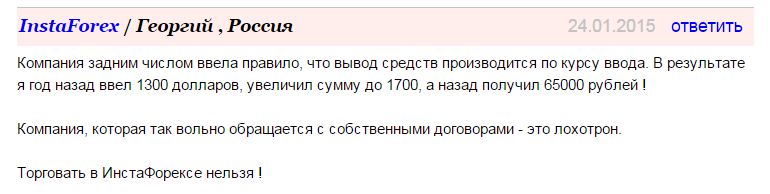

Hence it may not be accurate and we tend to be transparent and precise with everything. Please note that we have been working in the Forex market for 18 years. People who write reviews have ownership to edit or delete them at any time, and they’ll be displayed as long as an account is active. The Client accepts that in market conditions different from regular, the Client’s order processing time may increase, the spread may be widened, and also an execution quote may differ from quotes in the flow. I just want to learn trading but they cancelled my order because of limitations. They suggest demo account but who will learn in demo account if its not real money you lose.

FXTM Review 2023: Is This Broker Platform Safe for Trading? – CryptoNewsZ

FXTM Review 2023: Is This Broker Platform Safe for Trading?.

Posted: Thu, 20 Oct 2022 07:16:24 GMT [source]

Customer reviews are almost always likely to mention if a brokerage firm has technology issues, as that is universally frustrating. That leads us into our next topic, which is whether online brokers are safe to use. Luckily, the answer is yes, if the broker itself is legitimate and regulated. Online brokers are regulated by governing bodies like the SEC, CFTC, NFA, and FINRA. Most of the industry is heavily regulated, especially since the 2008 financial crisis, which spurred Congress to take a hard look at Wall Street.

#3 Rated Best Canada Broker

In the end, bad reviews plus bad support experience, I decided not to entrust my money with them. None of the Filers advertise in any Canadian media outlet of general distribution, whether in print, radio or television. Moreover, none of the Filers’ solicitation efforts in the U.S., whether by Internet, direct mail, advertising or telephone, are designed to be directed at Canadian residents. CySEC has listed all Forex brokerage companies on its website so that everyone can access and confirm their license and regulations if necessary.

Read fbs broker reviews that include these topics, and always conduct thorough research before settling on an online broker. Customer service should be responsive, friendly, and knowledgeable. It shouldn’t take a company more than forty-eight hours to respond to an email, and even that’s pushing it. High-quality customer support is a key indicator of a good firm. The Massachusetts Institute of Technology has called online trading an “internet revolution.” Despite the prevalence of online trading, choosing an online broker isn’t easy.

- You can fund your account with a credit card, debit card, or by wire transfer.

- FDC — the general distribution agent for all of Fidelity’s U.S. mutual funds.

- Disclosure laws mandate that the broker include the regulation in its company information.

- This means that the prime rate will need to be at least 5.50% before you’ll earn any interest on your cash balance with Questrade.

- We also compared AxiTrader’s fees with those of two similar brokers we selected, Pepperstone and IC Markets.

For those with less than $15,000 in your account, you will be charged a quarterly maintenance fee of $25. This can be waived if you set up a pre-authorized contribution of at least $300 per quarter. According to the information on Trustpilot, the reviews are somewhat mixed. There are both positive and negative opinions that cover various issues. 39% of all commentaries are “Excellent” while 27% appear to be “Bad”.

There’s no minimum balance requirement, which means that you can start trading with as little as $1. You can only trade Canadian and U.S. stocks with Wealthsimple. While stock trades are commission-free, Wealthsimple charges a 1.5% fee for converting CAD to USD, and vice-versa.

However, there are several additional things Forex traders should be aware of when using leverage. To impose administrative sanctions and disciplinary penalties to brokers, brokerage firms, investment consultants as well as to in any other legal or natural person whom fall under the provisions of the Act. The Investor Compensation Fund was founded within the framework of the CySEC organization to reimburse clients in the event of failure by ICF members to fulfill their obligations towards their clients. This program was set up to protect customers by reimbursing their assets if their claim is justified. The Investor Compensation Fund can be applied to all clients, Cypriot residents and foreigners who have received services from ICF members.